There are other popular energy efficient roofing shingles that may be a good fit for your home.

Is a new roof considered an energy efficient improvement uk.

What is considered an energy efficient improvement to a home.

Single ply membranes are pre fabricated sheets rolled onto the roof and attached with mechanical fasteners adhered with chemical adhesives or held in place with ballast gravel stones or pavers.

Under current law dec.

Energy efficient home improvements reduce the amount of energy you use in your home on a daily basis.

31 2016 was the deadline for qualifying improvements to the taxpayer s main u.

Reformulate or coat black membranes to make them reflective.

This includes the cost of installation.

How they can be made cool.

Such improvements can raise the.

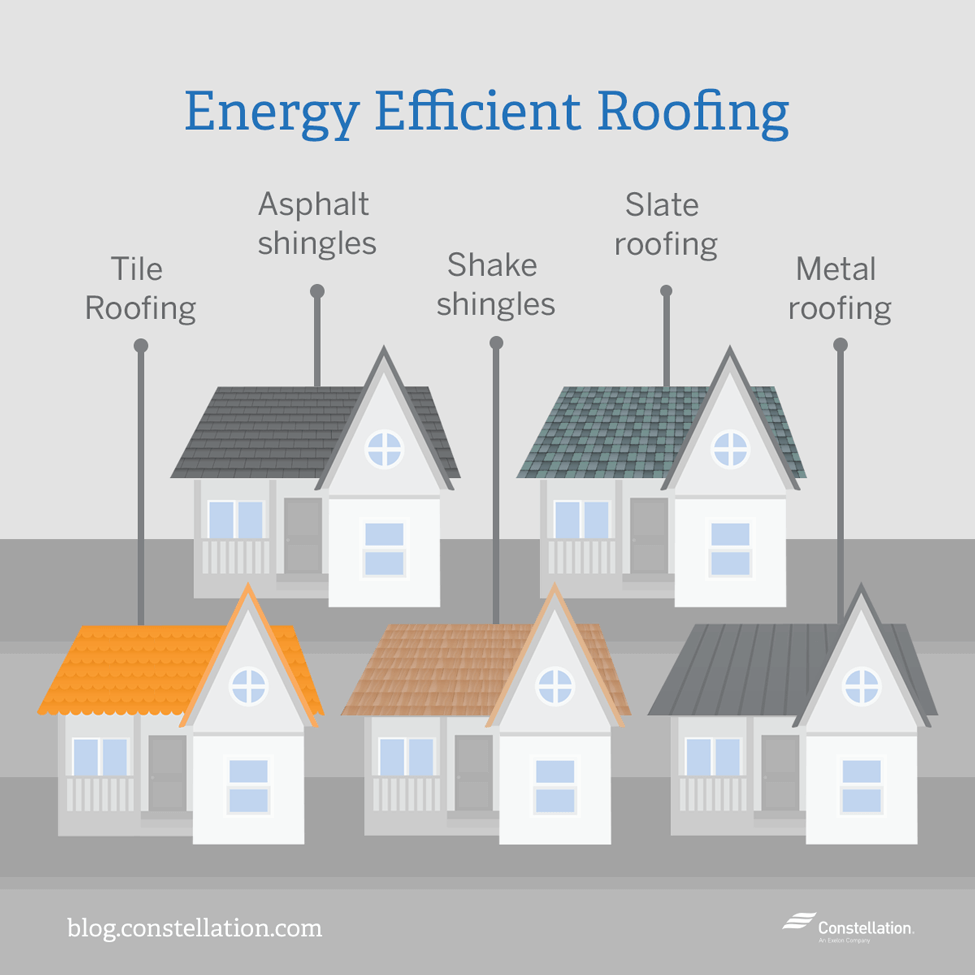

Slate roofing is a stunning energy efficient roof option that can last a lifetime.

Details of the nonbusiness energy property credit extended through december 31 2020 you can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

Is there a tax credit for roofs.

For example energy efficient exterior windows and doors certain roofs and added insulation all qualify but costs associated with the installation weren t included.

Other energy efficient roofing options.

Residential energy efficient property credit.

Its density helps to insulate your home making it a very eco friendly choice.

Here s how to add your roof tax credit to your tax return and the requirements to receive a roof tax credit.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration.

Home improvement tax credits for roofs.

If you re claiming an energy tax credit for a new roof you may qualify if your roof meets certain energy requirements.

If you are replacing or adding a new roof to your home you could qualify for an energy efficient home improvement tax credit for as much as 10 of the cost not including installation costs.

This tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home.

The second part of the credit isn t a percentage of the cost but it does include the installation costs of some high efficiency heating and air conditioning systems water.